In property management, staying on top of rent payments is critical for maintaining healthy cash flow and ensuring property owners receive consistent income. One of the most useful tools for achieving this is a delinquency report. But what exactly is it, and why is it so important?

What is a Delinquency Report?

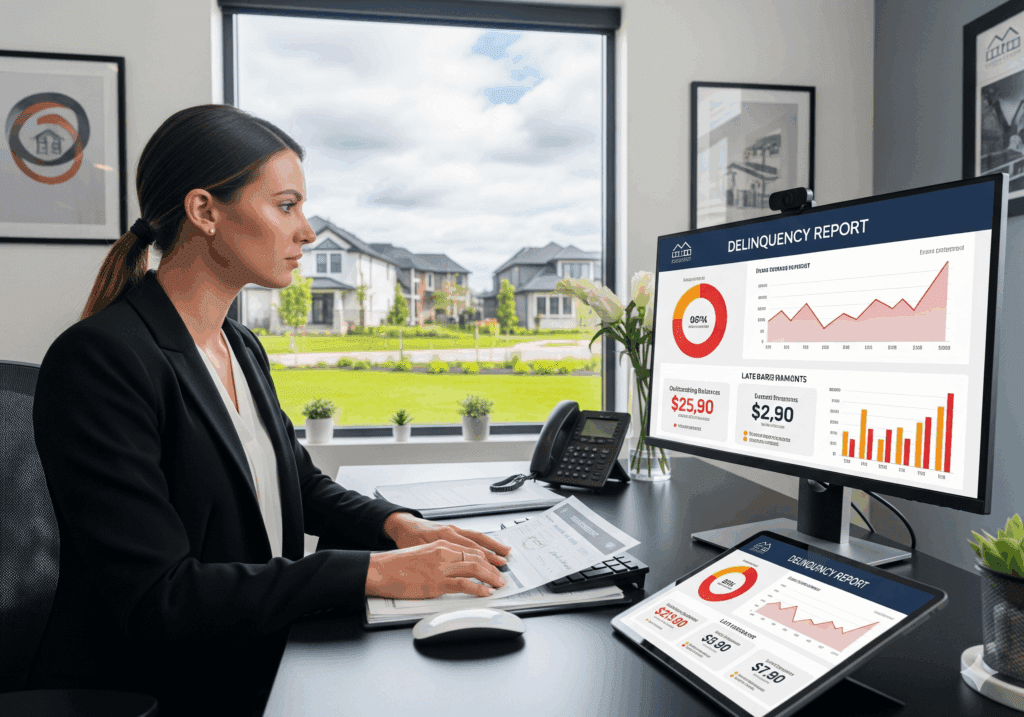

A delinquency report is a financial document that tracks all overdue or unpaid rent from tenants. It provides a clear picture of who owes rent, how much is owed, and how long the payment has been outstanding. This report is often generated monthly but can be reviewed weekly or even daily, depending on the size of the property portfolio.

For property managers, a delinquency report acts as a snapshot of rental income health, helping identify problem accounts and take corrective action before the issue escalates.

What Does a Delinquency Report Include?

While the format can vary, a typical delinquency report includes:

Tenant name and unit number

Total rent due

Amount paid and outstanding balance

Number of days past due (e.g., 30, 60, or 90+ days)

Late fees or penalties applied

Notes on payment arrangements or follow-up actions

Why is a Delinquency Report Important?

Improves Rent Collection

By identifying overdue accounts quickly, property managers can send reminders, apply late fees, or initiate collection efforts before the situation worsens.Helps Predict Cash Flow

Delinquency reports show which payments are delayed, helping managers adjust budgets and forecast income more accurately.Strengthens Communication with Owners

Property owners want transparency. Including delinquency details in monthly owner statements demonstrates proactive management.Highlights Tenant Trends

If a specific tenant frequently appears on the report, it may signal a need for better screening or intervention.

Using Delinquency Reports Strategically

A delinquency report isn’t just about tracking late payments—it’s also a tool for preventing future delinquencies. By analyzing patterns (such as tenants who often pay late), property managers can adjust policies, send earlier reminders, or offer automated payment options to reduce late payments.

Bottom Line:

A delinquency report is essential for keeping rental income on track. It gives property managers the insights they need to take timely action, maintain cash flow, and provide clear, accurate updates to property owners.